Step-by-step guide to file income tax return online through www.incometaxindiaefiling.gov.in :

Income Tax Department gave a glimpse for 3 pages Income Tax Returns for AY 2017-18 and it will be issued very soon by Income Tax Department of India and IT returns filing will be initiated with the same effect. Some newbies are not knowing the procedure to file income tax return online through incometaxindiaefiling website. So, here we present a simple step by step guide to file income tax return online from official website www.incometaxindiaefiling.gov.in.

File Income Tax Return for AY 2017-18

We have made a simple 10 step guide to file income tax return online for AY 2017-18 from incomeindiaefiling.gov.in, just go through these steps first to get the idea for what’s required and hence it will be easier to proceed for the same later on.

Also Read: GST Tax Rate in India: Final GST Rate Out

Things to keep ready: Before you start the process, keep

i) B@nk statements,

ii) Form 16 issued by your employer and

iii) a copy of last year’s return in hand.

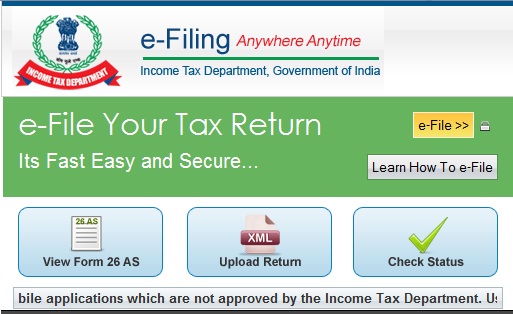

Next, log on to www.incometaxindiaefiling.gov.in & follow these easy 10 steps to file income tax return for AY 2015-16:

Step 1: Register yourself on the website. Your Permanent Account Number (PAN) will be your user ID.

or

If already has an account then login there.

Step2: View your tax credit statement — Form 26AS — for the financial year 2016-17. The statement will reflect the taxes deducted by your employer actually deposited with the I-T department. The TDS as per your Form 16 must tally with the figures in Form 26AS. If you file the return despite discrepancies, if any, you could get a notice from the I-T department later.

Step 3: Under the ‘Download’ menu, click on Income Tax Return Forms and choose AY 2017-18 (for the financial year 2016-17 ). Download the Income Tax Return (ITR) form applicable to you. If your exempt income exceeds Rs 5,000, the appropriate form will be ITR-2. If the applicable form is ITR-1 or ITR 4S, you can complete the process on the portal itself, by using the ‘Quick e-file ITR’ link.

Step 4: Open the downloaded Return Preparation Software (excel utility) and complete the form by entering all the details, using your Form 16.

Step 5: Ascertain the tax payable by clicking the ‘Calculate Tax’ tab. Pay tax (if applicable) and enter the challan details in the tax return.

Step 6: Confirm all the information in the worksheet by clicking the ‘Validate’ tab.

Step 7: Proceed to generate an XML file and save it on your computer.

Step 8: Go to ‘Upload Return’ on the portal’s left panel and upload the saved XML file after selecting ‘AY 2017-2018 ‘ and the relevant form. You will be asked whether you wish to digitally sign the file. If you have obtained a DS (digital signature), select Yes. Or, choose ‘No’.

Step 9: Once the website flashes the message about successful e-filing on your screen, you can consider the process to be complete. The acknowledgment form — ITR—Verification (ITR-V ) will be generated and you can download it.

Step 10: Take a printout of the form ITR-V , sign it preferably in blue ink, and send it only by ordinary or Speed post to the Income-Tax Department-CPC , Post Bag No-1 , Electronic City Post Office, Bangalore – 560 100, Karnataka, within 120 days of filing your return online.

That’s it.

www.incometaxindiaefiling.gov.in

As you would be knowing www.incometaxindiaefiling.gov.in is the official website of Income tax department of India for the purpose of filing of income tax return in India from past decade.

The links for login at www.incometaxindiaefiling.gov.in and links for form 26 AS for incometaxindiaefiling.gov.in would be also available from the website once you go over there from the link specified above.

Hope we guided you exactly for filing income tax return online on www.incometaxindiaefiling.gov.in website.

Sir Utility for AY 2015-16 is not available any idea when it will be available ?

I am Vidya. After uploading efile ITR-1 and before a click on ‘continue’ button it was delinked from Server. However, the file was uploaded and the acknowledgement number is available. It is 755301450310815. How to get the form ITR-V to be printed and send to Income Tax Department after verification.

Sir Utility for AY2016 is not available any idea when it will be available ?

Sir Utility for AY2016-2017

is not available any idea when it will be available ?

Sir Utility for

is not available any idea when it will be available ? mob 9968446146